2021 was another outstanding year for our clients. Total returns from 1 January to 31 December were well in excess of the mid-rate long term assumptions we use when creating financial strategies.

Our clients, who had their annual advisor review meetings towards the end of 2021, were informed of this. But how quickly markets change! For those who have had meetings with our advisors more recently, a very different picture has emerged.

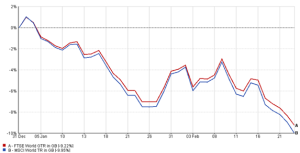

Market performance from 1 January 2022 to 24 February 2022

Overall, markets have declined this year (see chart below). There have been two main reasons for this.

- Inflation has spiked

UK inflation, which is the average rise in the prices of a basket of 650 specific goods and services, rose to 5.5% over the twelve months to January 2022. This is the highest in 28 years since 1992. In the USA, inflation surged to 7.5%, the highest since 1982.

What has this meant for you? Personal inflation can be very different from the headline inflation rate. Whilst we all have different shopping habits, thus our personal inflation rate will never be the same as the headline rate, it is highly likely that your grocery shop has become more expensive.

- Interest rates have risen

The Bank of England has increased interest rates twice since November 2021. This is normal monetary policy. One of the Bank’s main objectives is to keep inflation at 2%. On the Bank of England’s website it lists one of its jobs as ‘guarding the value of your money by keeping prices stable. We do this by setting the core interest rate at which we lend to the banks’.

When inflation rises, the Bank raises interest rates to reduce demand in the economy, which can realign the supply/demand equilibrium (when demand for a good reduces, prices tend to drop). This is the theory anyway, and history has shown that it can be quite effective, but it does take time for the full effects to be felt.

- Russia / Ukraine conflict

I mentioned that there were two reasons for the movements in markets and whilst this is broadly still the case, there have been some declines today as a result of the substantial escalation in the conflict (Russia has formally invaded Ukraine). Although our clients exposure to Russian and Ukrainian companies will be very minimal, we continue to monitor developments.

It should also be noted that geographically isolated conflicts have rarely been the cause of market declines. Since 2008 there have been countless conflicts, and whilst harrowing for those involved, most of the companies our clients are invested into continued trading, and the wheels of economies continued to trend upwards.

What does this have to do with investments?

In short. A lot. When inflation rises faster than wages people can afford to buy less of the same goods. Let’s take a single hypothetical example. If an Apple iPhone costs more than it did yesterday, and wages have risen by a lesser amount, fewer people can now afford an iPhone. This means that Apple will sell fewer iPhones so they make less profit. In turn, this affects their share price, because if a company makes less profit, the value of that company (its share price) should be lower.

Rising interest rates can have a similar impact. When interest rates go up, the cost of servicing debt is higher. Mortgage payments increase, the interest rates on loans increase etc. This again means that people have less money to spend, because they are paying more for their debt. In turn this leads to companies selling fewer goods, leading to lower profits, and lower share prices.

The above being said, it is incredibly rare for short-term shocks to markets to translate into long-term issues. Over-reaction and irrationality in the market over the short-term is commonplace (remember 2020!). If we take shares as a broad asset class, it is clear that it has provided the best protection against inflation over the long term. Companies on the whole are agile and can adapt business models and pricing at short notice. When needed, they, and we, adjust.

This looks like a vicious circle! How does it end?

Stabilising inflation is the priority for many central banks around the world. If interest rates need to be increased to combat this, it is deemed as the lesser of the two pains. It is incredibly difficult for people and businesses to plan and budget if price rises are too high.

Once inflation is under ‘control’ and at a more sustainable level, interest rates could be reduced to a more appeasing level. However, we should note that we have experienced historically low interest rates since November 2008, so there is no guarantee that they will return to the very low levels we’ve experienced over the past fourteen years.

In mid-2008 mortgage advisors were arranging mortgages at what seemed fabulous interest rates of around 7% per year. Who was to know that a mere twelve months later, and then for more than the next decade, you could have secured a mortgage for much less than half of that! What seems normal today, may be completely abnormal tomorrow.

What we can have a healthy amount of certainty around is, interest rates can only really go up! The base rate is currently sitting at 0.5%, still incredibly low.

Recent times, lest we forget.

During the last substantial covid-induced downturn in markets in 2020, when major markets fell by around 40%, we held our nerve. Unfortunately, some did not. They crystallised losses when the markets fell and then attempted to time their re-entry into the markets. Not surprisingly, they failed, and their total returns will always be impacted, and impacted significantly. We were very pleased to see that our clients trust our advice, not only when the outlook is rosy, but even more importantly when it is not.

We had some clients who took our advice and against their natural bias, invested during 2020 when it looked like we were on the edge of extinction. Sufficed to say, they have experienced significant returns.

House view

We continue to monitor our clients’ investments alongside our investment partners. But we won’t make irrational judgements based on fear. Decisions we make are in our clients’ long-term best interests. Like all the most successful investment managers of note, we won’t play the fool’s errand of over-emphasising the short-term with the funds we look after.

The last calendar year decline in the US main stock market was 2018 and before that, 2008. The only guarantee I can give you is that a market decline will happen at some stage. Whether it will turn out to be this year, I wake up every morning wishing I knew, but I’m comfortable in the knowledge that I don’t and I won’t. History tells us that our clients will likely be much better off if we remain patient during these times, and take wisdom from a play on the wartime slogan “keep calm and remain invested”.

Article written on behalf of the Investment Committee