2022 was a difficult year. We ended 2021 with the first interest rate increase in three years and only the third in over fourteen years from July 2007 to December 2021. Although it may at times seem that all of the economic turmoil of 2022 was due to the war in eastern Europe this is not wholly accurate. Twelve-month UK inflation (CPI) had risen to 5.1% in November 2021 and US inflation was at 6.8%. In December 2021 the Bank of England predicted that UK inflation would peak at around 6% in April 2022 but they revised this to 7.25% on 3 February 2022, before we definitively knew Russia would invade Ukraine.

The cash stock piles that households had built up during the covid restrictions, in conjunction with massive government spending and historically low interest rates had led to global supply issues. And when supply remains stagnant and demand increases, in a capitalist economy there is broadly one main way to decide who gets to purchase the goods and services we desire – the price mechanism.

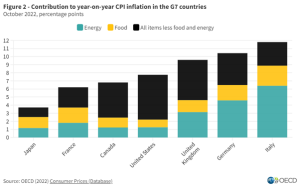

The chart below shows the inflation of some of the main OECD countries to October 2022.

Importance of controlling inflation

Raising interest rates is more effective in modern economies because countries with higher debts are broadly speaking wealthier than those with low levels of debt (Household Debt, OECD; Household debt, loans and debt securities, International Monetary Fund).

In isolation it can seem perverse to increase interest rates to reduce the demand of goods and services and sometimes intentionally manufacture a recession. I have summarised some of the effects of not combatting inflation, which some fringe ultra-free market liquidationist economists propose.

Effects of inflation remaining high

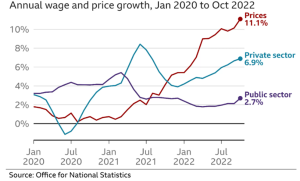

- Cash and wages fall in real terms. This is perhaps the most significant drawback and it generally hurts those on the lowest wages disproportionately because they tend to have less flexibility to negotiate.

- Lower-income individuals also tend to spend a higher proportion of their income on essential goods such as housing and food. A significant increase in inflation can tip these people into poverty.

- When inflation is rising it can make sense to make purchases more immediately, rather than wait for prices to go up. This can create significant peaks and troughs and it can be incredibly difficult for businesses to plan what resources they will need such as labour, buildings and materials and how much these will cost. You can’t plan effectively for the following year if your costs will increase in an unplannable manner.

Negative inflation

Negative inflation (deflation) may seem a world away right now but there have been several occasions when this has been a real worry. In September 2015 CPI was at negative 0.1% year to date and in 2020 it ended at plus 0.6% year on year. Both times the Bank of England took action to increase inflation. Two of the main negative consequences of deflation are listed.

- When prices are reducing why buy now when you can buy later for cheaper? Would you buy a house now for £700,000 when you get it for £650,000 in a few months’ time?

- If prices are reducing is it reasonable to reduce your employees wages as well? I wonder how they would take this.

It’s blowing in the wind?

At a recent review a client opined that the answer to when inflation would come down and the economy would recover was “blowing in the wind”. This is not far from the truth. Any specific projections of the future are highly likely to be wrong, especially the further away we are from the event. As explained at the start of this email the Bank of England, with all their world-leading expertise and historic experience, can change their forecasts considerably within the space of a few months. Nevertheless, it is rare for the Bank of England to be totally off the mark – after all they did predict high inflation for 2022 albeit not at the levels we actually experienced.

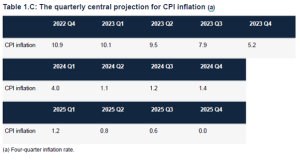

Below are two charts summarising how the Bank estimates inflation will develop over the next three years.

Source: Bank of England Monetary Policy Report November 2022, page 22.

Source: Bank of England Monetary Policy Report November 2022, page 21.

Forecasts are mostly unanimous that inflation will fall considerably by the end of 2023 and continue this trend into 2024. I recently heard Rishi Sunak claim that he will halve inflation. This made me chuckle seeing as though this was already estimated a few months ago. I think what he meant to say is “I won’t create chaos and make it worse” which, given recent times, is in itself a noble aim.

The above charts do not seem unreasonable. From 1998 to the end of 2021 inflation averaged just below 2% per year; even if you include the period to November 2022 inflation has averaged circa 2.5% (Bank of England inflation calculator). This is mostly synonymous with our financial planning which errs on the side of caution with regards to many factors, so that even if one is worse than expected other factors can mitigate the impact.

Mortgage Rates

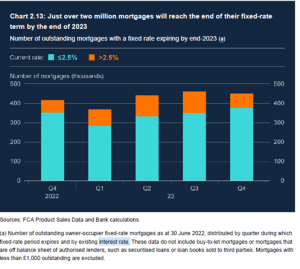

Interest rate rises are intended to make us spend less. Around 30% of UK households have a mortgage with c80% of these on fixed-rates. Over two million mortgages reach the end of their fixed rate between August 2022 and December 2023. This is one of the reasons inflation is expected to reduce significantly this year and in 2024, as the disposable income available to mortgagors reduces sharply.

One interesting slightly absurd fact to note is that those with higher loan-to-value mortgages tend to expose themselves to more risk than those with lower loan-to-value mortgages, “a borrower at 95% LTV is around two to three times less likely to take out a 5-year fixed-rate contract, compared to a borrower at 70% LTV” (The demand for long-term mortgage contracts and the role of collateral, Staff Working Paper No. 1,009, January 2023). It is incredibly important that mortgagors consider their ability to repay their mortgage properly should rates increase. In my opinion advice in this area is weak, with people using mortgage advisors but not actually receiving full advice. Anecdotally I have heard of mortgage advisors often asking clients what they want, rather than giving unequivocal evidence-based advice with reference to the clients’ needs and personal circumstances. The reply to “would you like a two or five year fix?” shouldn’t be the most pertinent decision making factor.

With our own mortgage advisors in-house we encourage clients to use their services, especially because we already have in-depth knowledge about you and can work in tandem, rather than seeing a mortgage (often the biggest expense!) as some sort of separate service. We focus on giving advice that is relevant to peoples’ needs.

Since the financial crisis mortgage lending has become more restrictive and affordability criteria stronger. Barring pernicious unexpected life events, those who were lent to should be able to absorb substantially higher interest rates and help the economy reduce inflation without having to resort to defaulting – you can thank me later for playing my part!

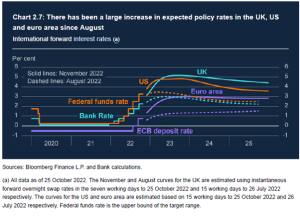

The Bank of England base interest rate is expected to peak around the middle of 2023 but the increases have already been priced into new fixed-rate mortgages so, based on what we know today, we shouldn’t see huge shifts one way or another this year.

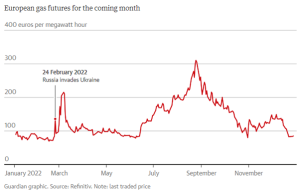

Gas and oil prices

More so than usual, the price of these commodities was of course very volatile over 2022. However the wholesale price has come down dramatically during the past few months.

I wouldn’t bet on the price we pay for oil and gas to substantially decrease anytime soon. The wholesale price is of course linked to the price we pay but there is usually a time lag. Providers purchase in advance and the forward price is affected by many factors. Over the long-term, though, if the trend continues we could experience lower prices (perhaps an obvious statement – can it get any higher?!).

Planning, Planning and Plans

“Plans are worthless, but planning is everything… if you haven’t been planning you can’t start to work, intelligently at least” (US President Eisenhower, The New York Times, November 1957).

This seemingly paradoxical statement has been repeated in many different iterations over the years and will continue to be. Without planning and context taking even positive actions can be sub-optimal. Take the example of over-saving into a pension. Whilst not an absolute negative it can be a sub-optimal action to take unless you have interrogated the alternatives. Gifting too much is another one that springs to mind but there are too many to mention here. Without a plan our aims are not quantified and challenged. And without proper aims, well, we’re pretty aimless.

I hope that 2023 brings us some better times but the only guarantee I can give you is that 2022 is not going to be the last time we experience economic turmoil (and a likely recession). On an ongoing basis, rain or shine, we will continue to work with you to plan for these events, and take advantage of them in some instances, because occasional economic turmoil is one of life’s few certainties.

Faraz Rahman Chartered MCSI, IMC

Financial Planner