The word ‘annuity’ and ‘good value’ are not words I’ve used in the same sentence too often for a while, however, given the close relationship between interest rates and annuity rates they are a hot topic for consideration for anyone looking to secure an income as we enter 2023. Whilst the surge in the cost of borrowing has been a concern for mortgage borrowers over the last 12 months, it has created a potential windfall for those hitting retirement age.

‘What’s the benefit of an annuity?’

Essentially annuities provide a guaranteed income in exchange for a capital sum. The income is guaranteed for life and removes the risk that income will ‘run out’ even if you live to the grand old age of 123, beating the current record set by Jeanne Calment who passed in 1997.

‘Why have I not been recommended an annuity already?’

It’s widely acknowledged that the level of income offered by annuities has been dismal over the last decade and as a result fewer and fewer people have been willing to give up their capital and buy an annuity. This trend started in the summer of 2007 as the credit crunch bit and the bank of England reduced interest rates at record pace. In 2015, when pension freedoms came into force, annuity purchases dropped further still. Data from the FCA in March 2022 revealed that in the previous year, just 9.71% of people accessing their pension funds for the first time chose an annuity. My suspicion is that these numbers will be much higher when the data is updated later this year.

‘So how have pensioners been surviving with such poor returns on offer from annuities?’

Over the last decade more and more pensioners have been leaving their capital invested and drawing down income payments on a regular or ad hoc basis. Ultra-low interest rates have meant that they have not needed to earn much in the way of return to be better off than they would be if they bought an annuity. Whilst pensioners who have remained invested have been exposed to investment risk, in our experience many have been rewarded for the risk taken.

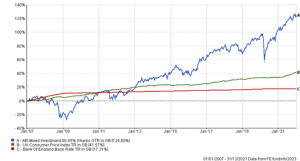

*ABI mixed investment 40-85% is the average returns of all pension funds allocated to this sector and provide an example of the returns experience by an average medium risk investor.

The graph shows the total returns for the ABI mixed investment sector for the 15 years up to the end of 2021 as just under 125%. Converted to an average annualised return this equates to around 5.5% per year, compared to the average bank rate which was 1.07% and inflation at 2.34% per year.

As a consequence of the poor value offered, over time pensioners and advisers have cemented the view that annuities aren’t worth considering. The shift in interest rates in 2022 has aroused attention and challenges this view, putting annuities firmly back on the table for consideration.

‘How much have annuity rates improved?’

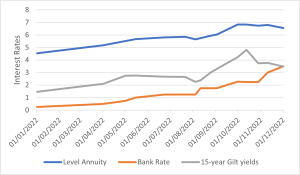

The chart below uses data from one of the UK’s leading annuity providers, Canada Life, which highlights the relationship between interest rates and annuity rates during the course of 2022.

Based on a 65 year old, single life annuity, level annuity with a 10 year guarantee.

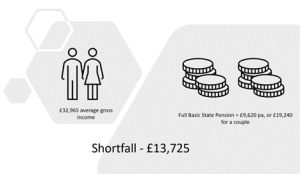

The impact in monetary terms on real life situations has slashed tens of thousands, and in some cases hundreds of thousands, off the level of pension capital needed to facilitate a secure retirement for ‘the average couple’.

If this sounds dramatic, let’s look at a theoretical ‘average’ 67 year old couple, both in receipt of full flat rate pension, that wish to top up their income to a level in line with the average UK earnings using an annuity.

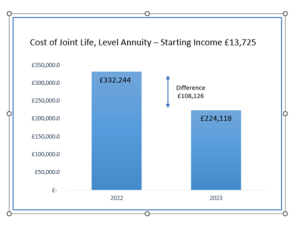

The chart below highlights how fortunes have changed over the course of 2022 for this ‘average’ couple. Remarkably, the level of capital needed to provide a level income of £13,725 has fallen almost a third over the course of just 12 months.

Source Canada Life*

Interestingly, the same couple seeking an escalating annuity linked to the retail prices index will have seen the cost of securing £13,725 of income fall by a 41% from £704,931 to £290,903 over the same period.

‘But if I die early I won’t get all my money back.’

A concern we sometimes hear from clients considering an annuity is whether they will, at the very least, receive their original capital back. Comparing the level of capital needed to buy a fixed income of £13,725 pa allows us to more easily calculate how long it takes to receive the original capital sum back. Over the last 12 months this has reduced from around 24 to 16 years.

| Life Expectancy (67 year old female) | Age | Duration | Total Income |

| Average Life Expectancy | 89 years | 22 years | £301,950 |

| 1 in 4 Life Expectancy | 96 years | 29 years | £398,025 |

| 1 in 10 Life Expectancy | 100 years | 33 years | £452,925 |

Source Canada Life*

‘Can’t I get a better return by remaining invested?’

Another way of assessing whether an annuity is right for you is to understand the return that would be needed to match the level of income that is provided by an annuity. We estimate that the annualised net return is now somewhere between 3-5%, for a level annuity depending on life expectancy. At the start of 2022, when annuity rates where much lower, the returns needed were somewhere between -0.40% -2.10%.

Historically, many investors have been able to secure higher returns than those highlighted above, and our expectation is over the long term many will continue to do so. That said, not everyone is comfortable with the ups and downs of investing and the level of return investors should expect to receive is directly linked to the level of risk they are willing to accept. This doesn’t specifically mean than annuities are only suitable for low-risk investors. We would encourage all clients approaching or in retirement to review the current landscape and take advice on how an annuity could support their retirement aspirations and goals.

‘My fund value has dropped so now isn’t the right time to cash in and buy an annuity.’

Although pensioners may have seen their fund values drop, the fall that the average medium risk investor is likely to have experienced in value of their pension fund, is likely to be much less than the increase in annuity rates over the same period. Therefore, we are seeing investors can secure a higher level of income with their pension capital, despite the fact that values have fallen over the previous 12 months.

| Capital Value (average pension fund **) | Example Level Annuity | |

| January 2022 | £100,000 | £4,131 |

| January 2023 | £90,000 | £5,512 |

An example of this is highlighted in the table above using data on average fund performance ** taken from the Association of British Insurers (ABI). This indicates that the average pension fund in the ‘Mixed Investment 40-85%’ sector will have suffered a fall in their pension value of just under 10% over the course of 2022. Over the same period, level annuity rates have increased by over 48%.

‘Should I convert all my pension capital to an annuity?’

There isn’t a uniform answer to this and whether or not an annuity is right for any one person or couple will depend on the individual circumstances. There are downsides to annuities such as the lack of access to capital, a lack of ability to vary income and the lack of a legacy for loved ones. For some, they simply might not provide the level of income needed or desired, even at the current higher rates.

Whilst annuities offer options that can be used to mitigate some of the downsides, the fact remains that they are an irreversible transaction and for some the idea of giving up access to all their capital is a price they are unwilling to pay in return for the guaranteed income offered.

Whatever your situation, it is worth remembering that it doesn’t have to be all or nothing. Diversification is a key financial planning principle, a combination of an annuity purchase and leaving some funds invested has the potential to improve financial security whilst still keeping access to some capital. Some pensioners will be in the fortunate position of being able to have their cake and eating it.

‘I don’t have a pension so can I benefit from the rise in annuity rates?’.

Typically, annuities have been used by individuals looking to convert their pension capital to income. However, the use of annuities is not limited to pension funds. We have also seen a rise in the level of income that can be secured for those looking to convert other capital to secure income, for example, to fund care fees.

What next…

The decision to buy an annuity is one of the biggest financial decisions many of us will make. Taking advice from an experienced financial planner will help assess whether an annuity is right for you and recommend the right ‘bells and whistles’ to incorporate into an annuity purchase, such as protecting some or all of your pension capital for your loved ones.

We are experienced in helping people approaching retirement explore the most suitable retirement options. As independent financial planners we will research the whole market before recommending an annuity or other retirement product.

If you would like to speak to one of our financial planners, then please call us on 01372 466790 or email info@tmfp.co.uk. We make no charge for an initial consultation and will help you decide if the service that we offer is right for you.

Annette Hender

Partner and Chartered Financial Planner

References / Sources

All annuity rates used in this article were supplied by Canada Life*.

Life Expectancy Data – https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/lifeexpectancies/articles/howlongwillmypensionneedtolast/2015-03-27

Average Household spending data – https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/financialyearending2021

Average UK earnings taken from the ONS report detailing the median disposable household income at March 2022, converted to a gross income assuming 2 retirees in one household.

Taylormade Financial Planning LLP is authorised and regulated by the Financial Conduct Authority No 535867